federal income tax rate 2020

2020 Simple Federal Tax Calculator. How Income Taxes Are Calculated First we.

How Do Federal Income Tax Rates Work Tax Policy Center

Effective tax rate 172.

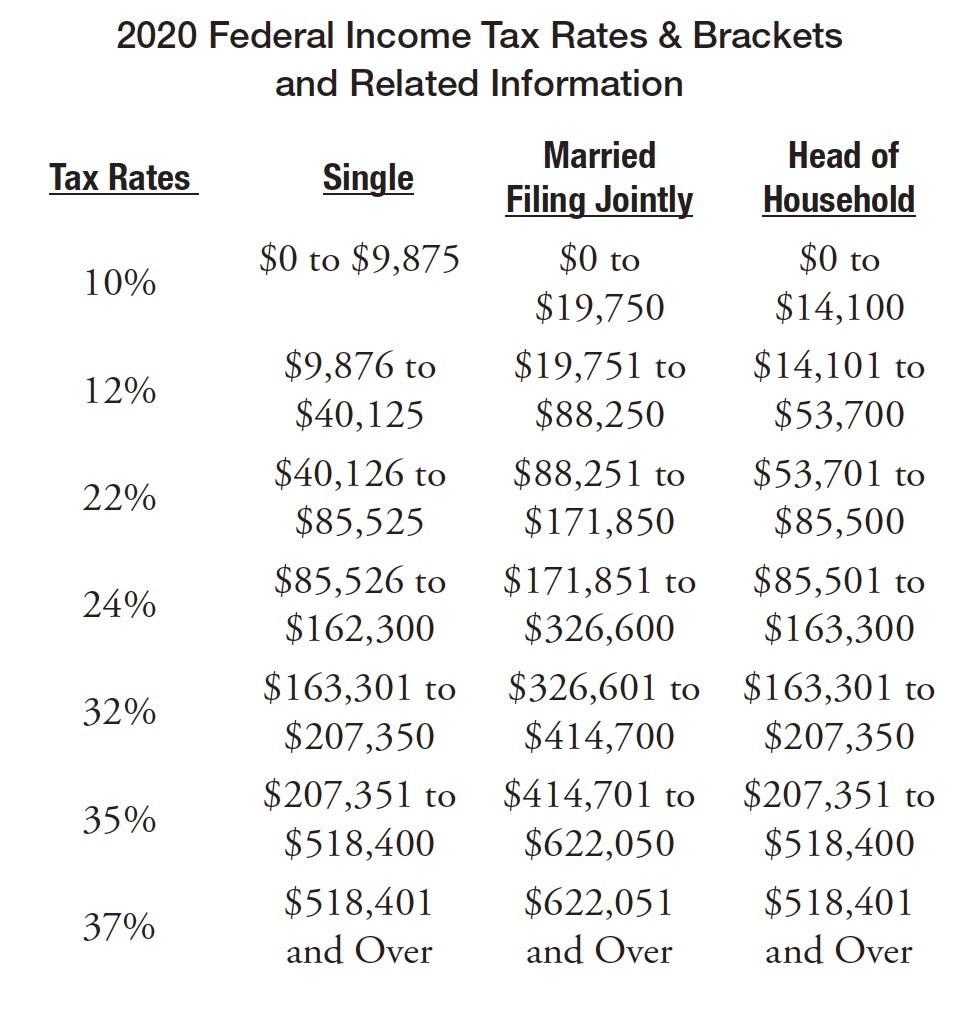

. Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37. There are seven tax brackets for most ordinary income for the 2020 tax year. Publication 505 Tax Withholding and Estimated.

For Wages Paid in 2020 The following payroll tax rates tables are from IRS Publication 15 T. The tables include federal withholding for year 2020. The Federal Income Tax Brackets.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. 10 percent 12 percent 22 percent 24 percent 32. Updated with tax rates for tax year 2020 due April 2021 Single Married Jointly Married Separately Head of Household Marginal Tax Rate.

The current federal income tax rates are 10 12 22 24 32 35 and 37. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year. Quickly Estimate 2020 Income Taxes Income Tax Refunds for 2021.

How to calculate Federal Tax based on your Annual Income. The 2020 Tax Calculator uses the 2020 Federal Tax Tables and 2020 Federal Tax Tables you can view the latest tax tables and. Your income is taxed at a fixed rate for all income within certain brackets.

Federal Income Tax Rate 2022 - 2023. To see the 2019 and 2020 tax rates and income ranges check out this article where we outline what the current. Tax rates for previous years 1985 to 2021.

To find income tax rates for previous years see the Income Tax Package for that year. For 2018 and previous tax years you can find the federal. Enter your filing status income deductions and credits and we will estimate your.

For help with your withholding you may use the Tax Withholding Estimator. Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24. The TCJA reduced the percentage rates of five of the seven tax brackets from what they were in tax year.

What are the current tax brackets for 2020. If youre one of the lucky few to. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck.

This is tax withholding. 2021 Federal Income Tax Rates - Tax Year 2020. The information you give your employer on Form W4.

Tables for Percentage Method of Withholding. You can use the Tax Withholding Estimator to. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

As your income exceeds a bracket the next portion of income is taxed at the next bracket and so on.

Michigan Family Law Support Feb 2020 2020 Federal Income Tax Rates Brackets Etc And 2020 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Michigan Family Law Support Feb 2020 2020 Federal Income Tax Rates Brackets Etc And 2020 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

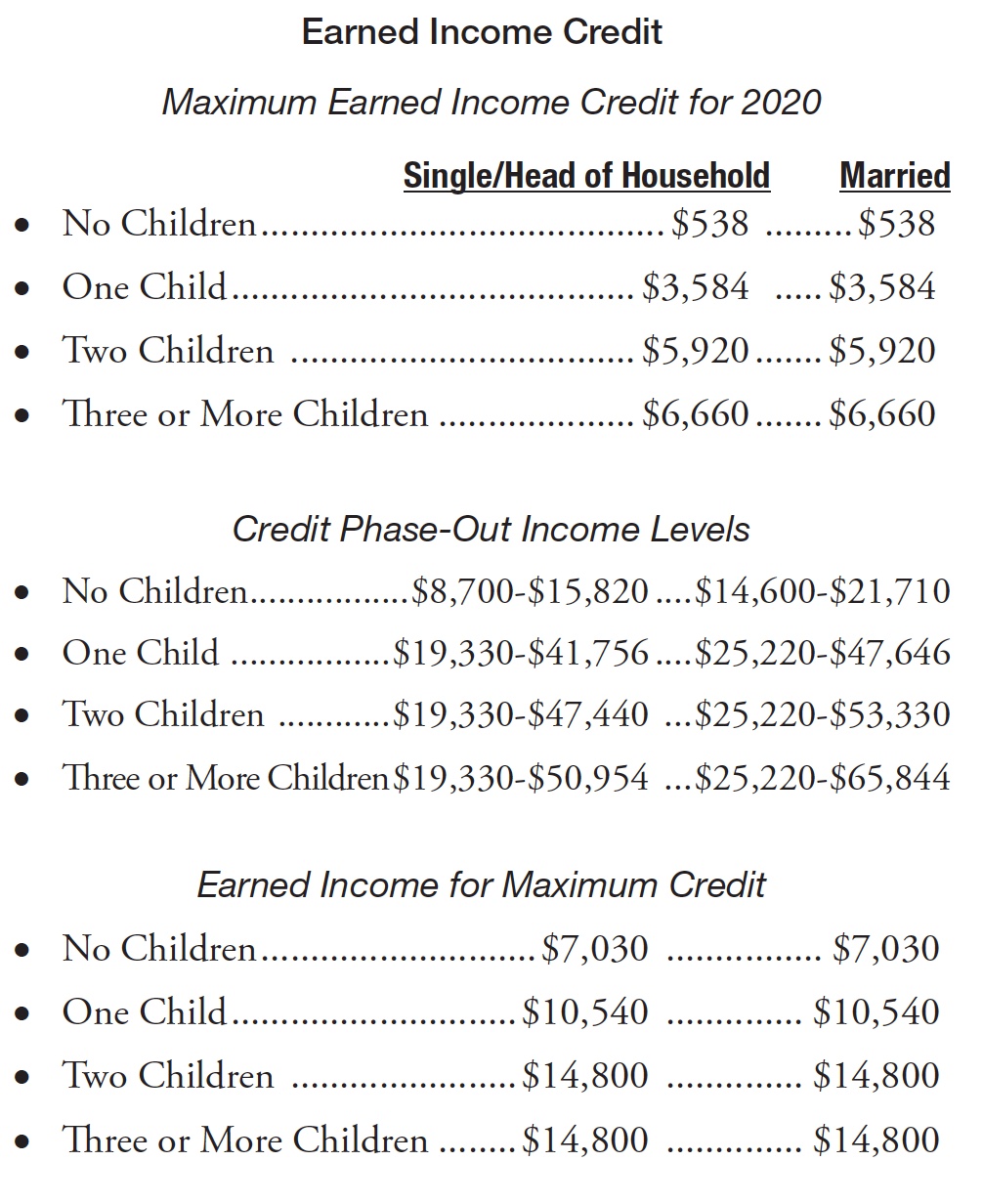

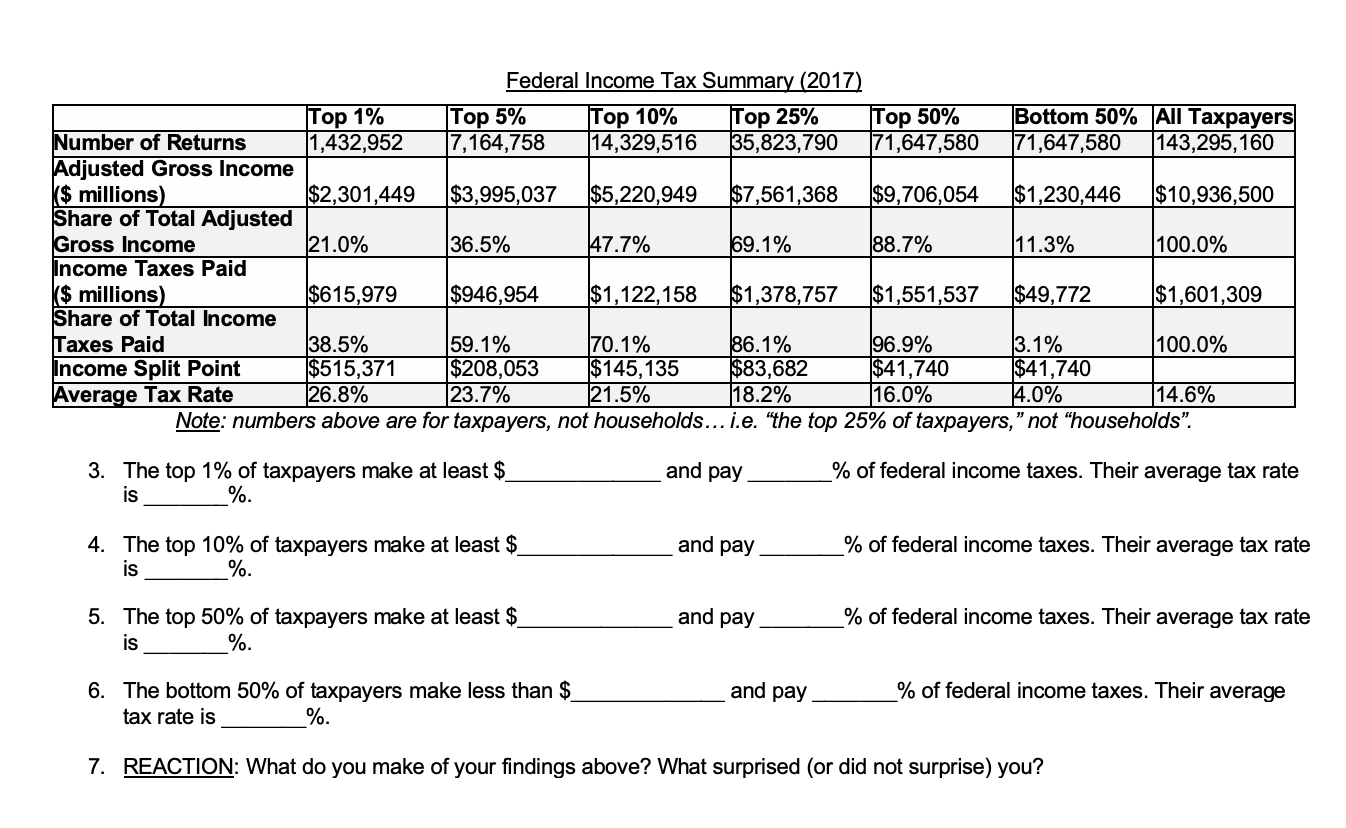

Who Pays Income Taxes Foundation National Taxpayers Union

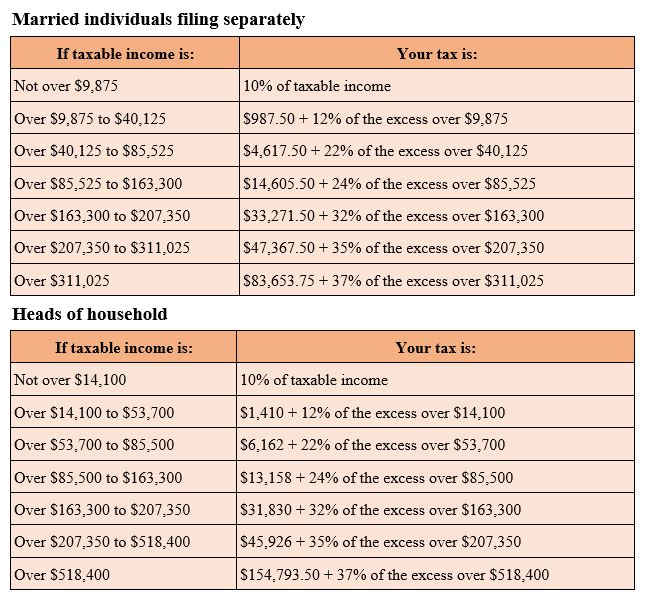

2021 Tax Thresholds Hkp Seattle

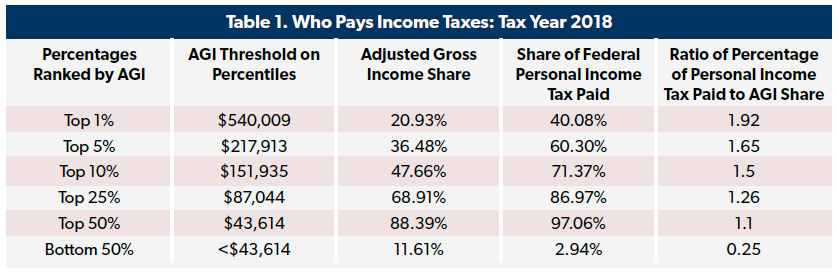

2020 Federal Income Tax Rate Schedules Individuals Trusts And Estates Heart Strong Wealth Planning

New Yorkers Paid Less In Federal Taxes In First Year Of New Federal Tax Law Empire Center For Public Policy

2021 Tax Brackets Standard Deductions Dsj Cpa

2019 2020 Federal Income Tax Brackets Side By Side Comparison Gone On Fire

Solved Marginal Tax Rate Individual Income Tax Brackets Chegg Com

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Sources Of Us Tax Revenue By Tax Type Tax Foundation

Who Pays Income Taxes Foundation National Taxpayers Union

How The Tcja Tax Law Affects Your Personal Finances

2020 Federal Personal Tax Rates

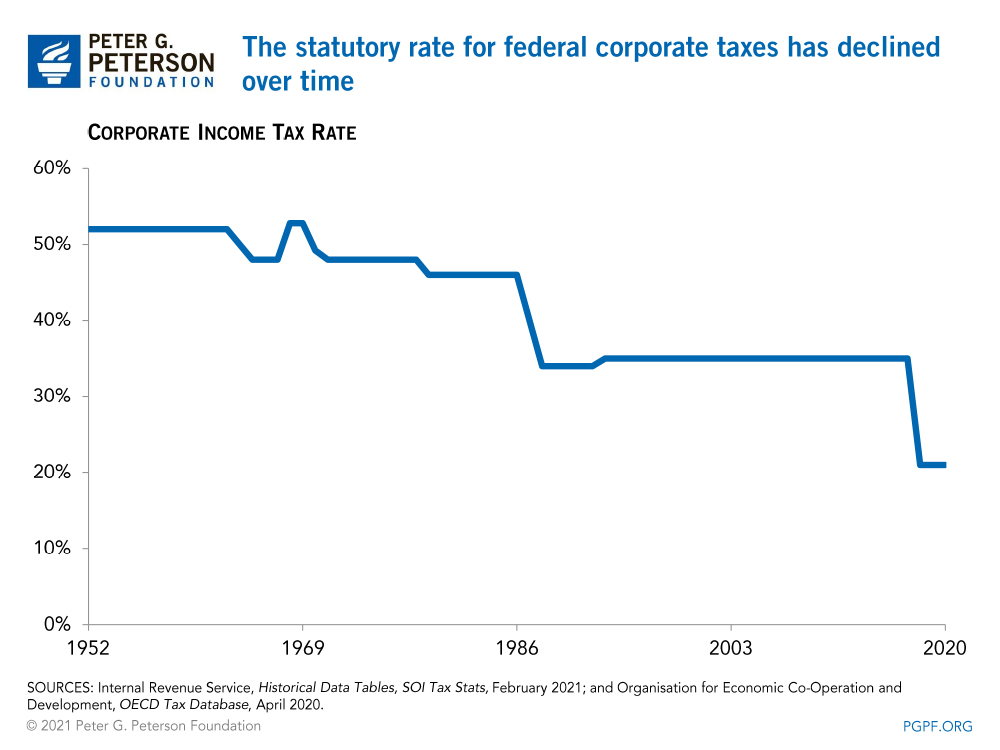

The U S Corporate Tax System Explained

New Federal Income Tax Rates For 2020 Money Savvy Mindset

What Are The Income Tax Brackets For 2020

How Do Federal Income Tax Rates Work Tax Policy Center

Policy Basics Marginal And Average Tax Rates Center On Budget And Policy Priorities